The State of GenAI in Marketplaces 2026

GenAI is now a core growth driver for marketplaces. Its integration into the workflows that determine how marketplaces operate, scale, and compete is reshaping the underlying mechanics of commerce, accelerating growth, trust, and liquidity faster than any tech wave since mobile.

Across ten interviews with marketplace experts in the United States, Europe, Asia, and Latin America, and top marketplace investors, the majority agreed that GenAI’s biggest impact today is happening behind the scenes: in catalog structuring, seller onboarding, and operational QA.

Meanwhile, adoption is deepening fast. OpenAI reports that enterprise use of ChatGPT grew eightfold last year, with API reasoning token usage expanding 320x, a clear signal that AI is no longer a tool, but infrastructure. Yet most companies remain early: according to McKinsey, 64% of organizations are still in the experimentation or pilot phase, not yet scaling AI across the enterprise.

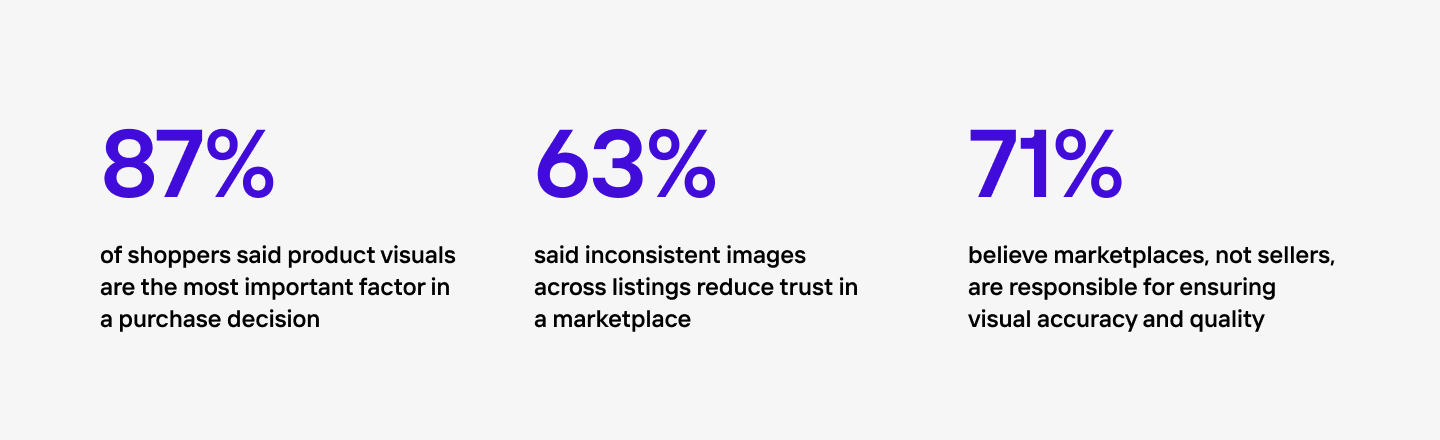

And while operators are adapting internally, consumers are adapting externally. In a Photoroom-commissioned consumer survey of 2,000 UK respondents, 87% of shoppers said product visuals are the most important factor in a purchase decision, and 63% said inconsistent images across listings reduce trust in a marketplace. Another 71% believe marketplaces, not sellers, are responsible for ensuring visual accuracy and quality.

This report explores how GenAI is changing marketplaces today, and what operators need to do next.

Industry voices behind this report

Where GenAI creates marketplace value

Growth & revenue

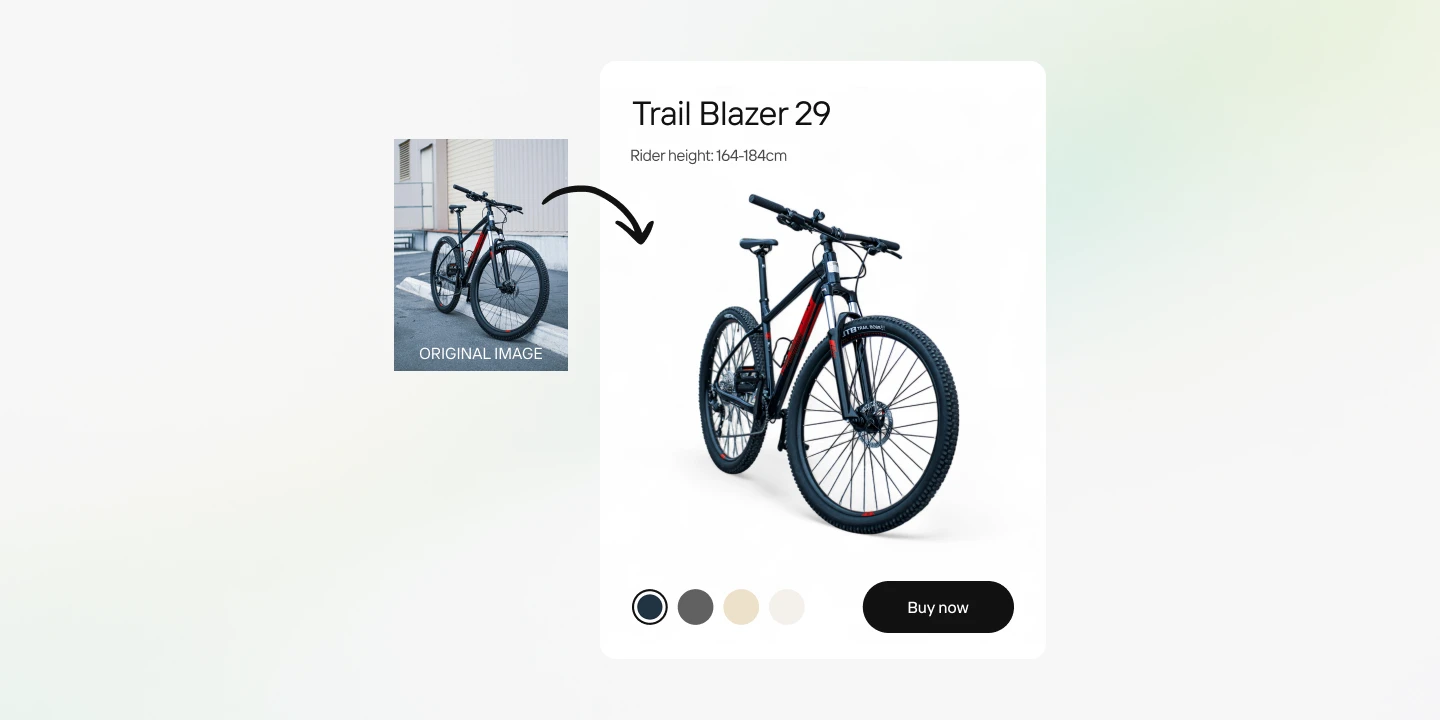

AI is directly increasing marketplace revenue by improving how products are presented and discovered. The clearest signal comes from image quality: Rappi projects a +20% uplift in buyer conversion from AI-enhanced photos alone. That gain isn’t just about better visuals; it proves how incremental improvements at the listing level compound into marketplace-wide revenue. Faster, higher-quality listings bring inventory live sooner, improve discovery, and reinforce the entire supply-demand flywheel, compounding growth across categories and markets.

Over half of UK shoppers (51%) say they would switch to another marketplace if it offered clearer, more accurate product images, a figure that climbs to two-thirds among 18-34 year-olds. For marketplaces, this means that improving image clarity is not just an optimization, it’s a direct growth lever that influences loyalty among the most active and comparison-driven buyers.

Seller experience & discovery

Nearly half of marketplace sellers still create listings and set pricing manually, losing hours each week to repetitive work. GenAI is removing that friction, automating listing text, categorization, pricing hints, translations, and photography. At Wolt and Rappi, onboarding is now near-instant. Vestiaire Collective goes further, generating titles, attributes, and pricing from minimal seller input. The result: richer supply, faster onboarding, and sellers empowered to focus on creativity and service rather than admin tasks.

This acceleration benefits buyers as much as sellers. Cleaner, more complete listings improve discovery, search relevance, and trust, making it easier for shoppers to find what they want and buy with confidence. In our UK survey, 62% of consumers said marketplaces should help sellers improve their listings, and 51% said most listings look acceptable but still fail to inspire full confidence to buy. Those confidence gaps are widest among younger shoppers, the same group driving marketplace liquidity, showing why AI tools that raise baseline listing quality are critical for both sides of the marketplace.

Operational efficiency

Operational excellence in marketplaces depends on speed, accuracy, and scale, and GenAI is impacting all three. At Wolt, AI-driven image quality checks reclaimed 100+ human hours per day once lost to manual QA. Turo’s AI chatbot now handles repetitive support queries, reducing cost per transaction. These efficiency gains don’t replace people; they refocus them on high-leverage work, strengthening catalog quality, trust, and growth at scale.

77% of consumers now believe marketplaces are responsible for ensuring that product listings are accurate and trustworthy. That makes operational efficiency more than a cost-saving measure, it’s a reputational safeguard that directly shapes user trust.

How AI is rewiring marketplace operations

Here are the 10 patterns that emerged across every interview: the surprises, the bottlenecks, and the changes that signal where marketplace innovation is heading next.

Table of contents

AI is fixing the product catalog before it fixes anything else

AI-assisted seller onboarding is solving the cold start problem

Structured data is the bridge between AI ambition and real-world mess

1. AI is fixing the product catalog before it fixes anything else

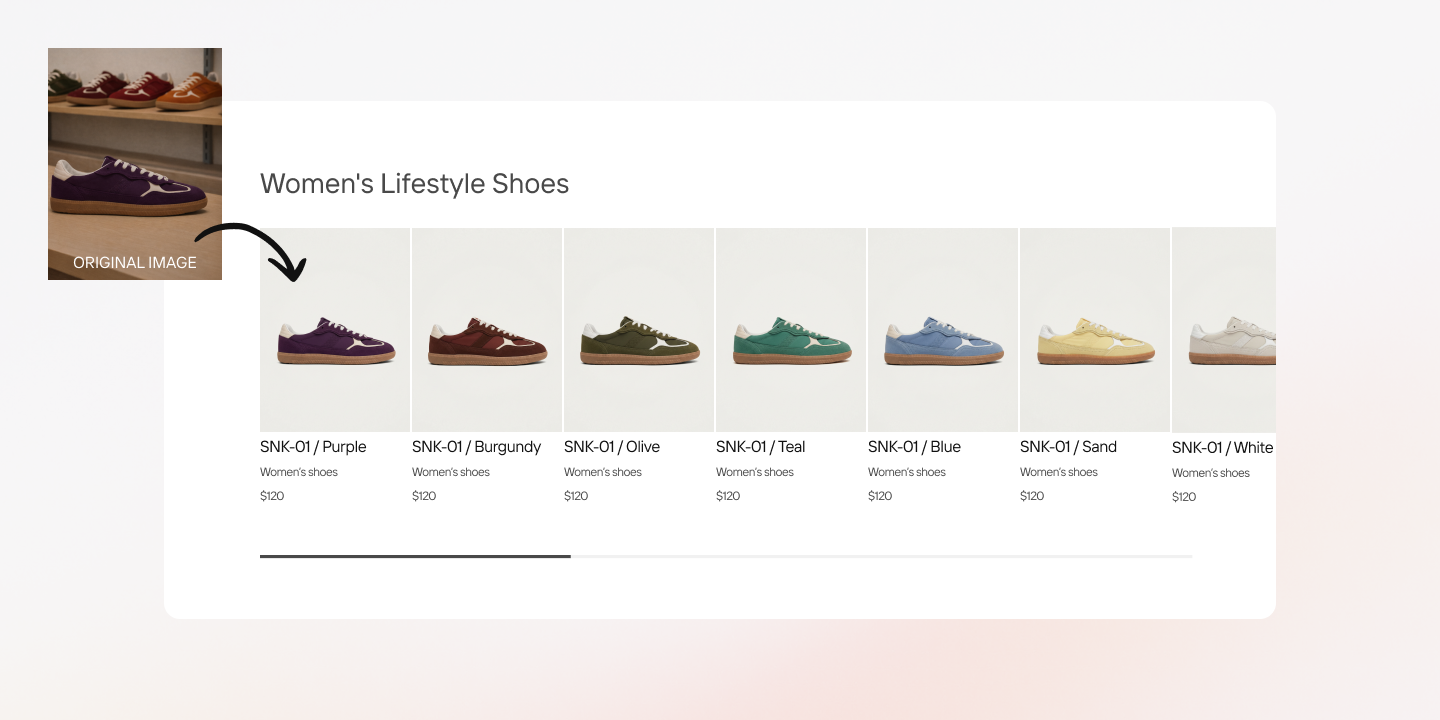

Before marketplaces can automate onboarding, enable natural-language search, or deploy AI agents, they need structured, trustworthy product data and consistent, realistic visuals. This foundational layer determines whether AI can perform at all. Previously, these workflows were heavily manual, with teams spending hours on image reviews, data corrections, and format alignment. Now, GenAI is automating those steps end-to-end, transforming bottlenecks into competitive advantages.

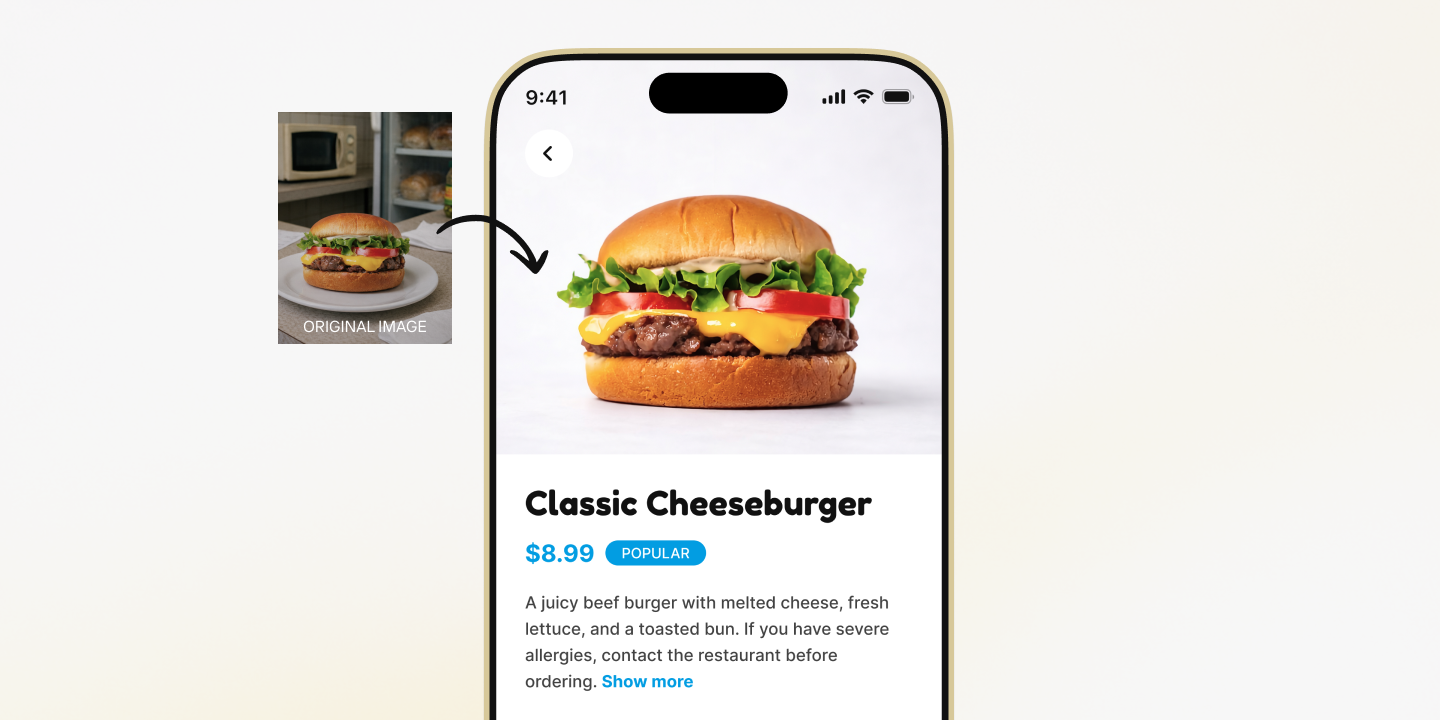

At Rappi, Latin America’s first “super app” for food and grocery delivery, GenAI turns chaotic PDF menus into structured SKUs. By extracting dish names, prices, customization options, and categories, Rappi expanded restaurant assortments and unlocked new zones far faster, activating sellers who had previously onboarded with only 20% of their menu and zero photos.

“Many restaurants onboard with only 20% of their catalog, but users want everything they see in-store. GenAI lets us replicate the full in-restaurant experience.”

–Nicolas Morales, Product Director at Rappi

Rappi isn’t alone. Across marketplace categories, GenAI is increasingly used to structure once messy, manual workflows that limited scale. At Wolt, slow and error-prone menu creation pushed the team to run a three-day hackathon, resulting in a GenAI-driven menu builder that went from prototype to live product in roughly six weeks and is now rolling out across markets.

Mercari applies AI to classify items, fill missing attributes, and generate product descriptions, reducing friction for casual sellers while strengthening ranking signals. At Vestiaire Collective, AI performs digital quality control, verifying that listing details, such as size, match what appears on garment tags in images and flagging discrepancies early, before they lead to costly returns.

If your catalog isn’t clean, nothing else, including search, recommendations, and AI agents, works well. The fastest-moving marketplaces treat catalog structuring and enrichment as a high-priority AI investment, not an afterthought.

2. Product images are infrastructure, not cosmetics

According to ConvertCart, 87% of shoppers say product visuals are the most important factor in a purchase decision. "People buy pictures and receive products" says Anne-Claire Baschet, Chief Data & AI Officer - Agentic Commerce at Mirakl. “You can’t afford to have any modification in the color, shape, or other product details.”

Every marketplace leader we spoke to agreed: image quality directly drives conversion and trust, yet it has historically been one of the least managed parts of the business.

At Wolt, thousands of blurry, low-resolution photos from merchants once flooded the platform daily. After automating image QA and enhancement with AI, the team reclaimed over 100 hours per day, time now spent supporting merchants rather than manually reviewing photos.

“Before AI, reviewing thousands of images a day across all our countries was a massive manual lift. Now auto-QA saves our team around a hundred hours a day, and when it breaks, everyone feels it immediately.”

–Jeff Strauss, Head of Imaging at Photoroom (Ex Director of Imaging Operations, Wolt)

Rappi saw the same pattern. Once they enhanced restaurant photos across menus, conversion rates increased by about 20%. But partial enhancement actually hurts trust. According to our data, 63% of consumers in the UK agree that variation in product images, styles, or branding across listings makes a seller or marketplace seem unreliable. “If we enhance only some photos, the restaurant menu looks weird, and conversion drops,” says Nicolas. “For big brands, we use AI to enhance everything or nothing.”

“Quality photos convert around 20% better than bad photos. That alone changed our vertical.”

–Nicolas Morales, Product Director at Rappi

The result: images have become a core input for liquidity, trust, and ranking, as fundamental as data quality or pricing accuracy. In fact, 55% of UK consumers say poorly executed AI-generated or heavily edited product images lead to decreased marketplace trust.

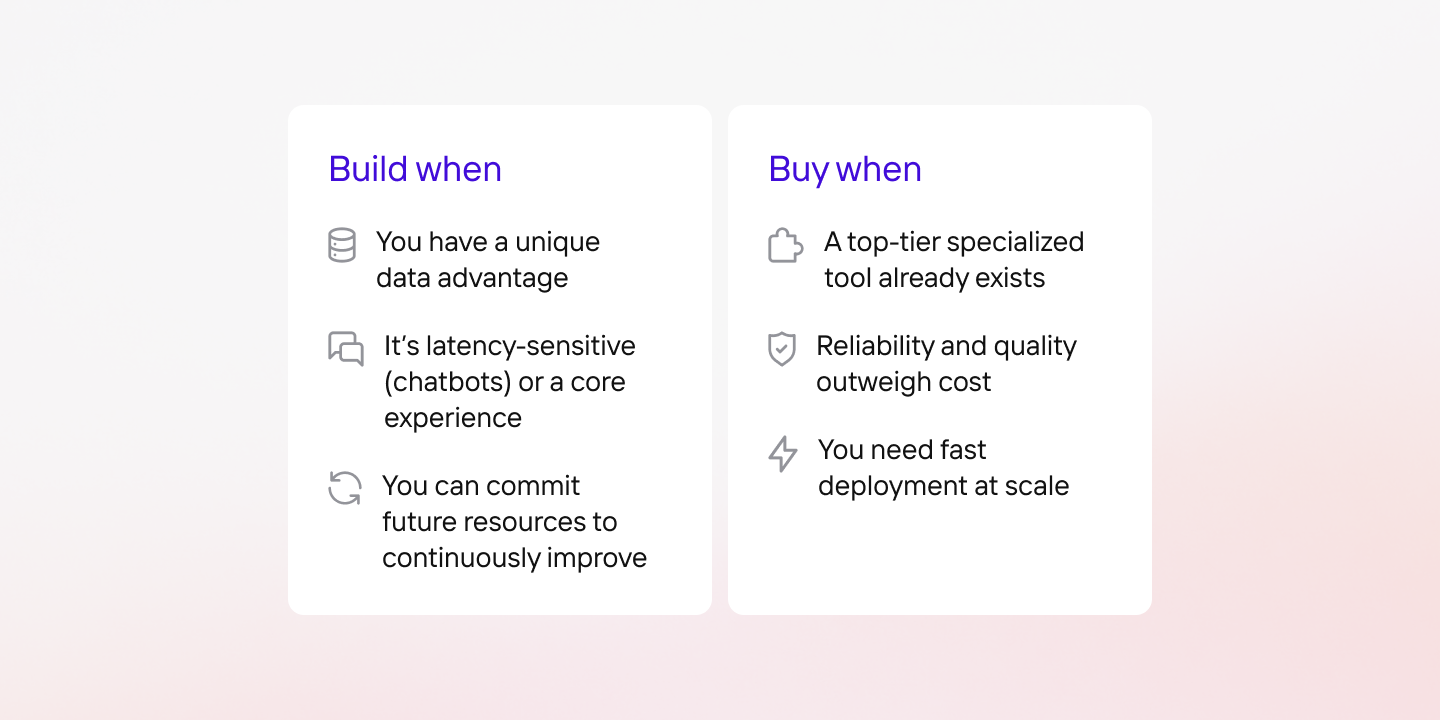

Build vs. buy: how to scale image infrastructure

For operators, the question now isn’t whether to automate image workflows, it’s how. Build when you have unique data or latency needs; buy when quality and reliability at scale matter more than custom control.

“We’re a food delivery company, not a photo-enhancing company. We can’t move at the same speed as AI models; that’s why we partner with companies like Photoroom.”

–Nicolas Morales, Product Director at Rappi

3. Trust breaks faster than it builds

In marketplaces, AI raises expectations, and the cost of not meeting them. According to our data, 78% of UK consumers expect online marketplaces to ensure that product listings are accurate and trustworthy. High-quality visuals and AI-assisted experiences can increase buyer confidence, but one misleading image can undo years of brand trust. “You have to be careful when there are real items,” says Olivia Moore, Partner at a16z. “Anything you generate has to be substantially similar to what the actual item will be when it’s delivered.”

Marketplace leaders are aligned on one thing: speed means nothing without precision. As Anne-Claire Baschet, Chief Data & AI Officer - Agentic Commerce at Mirakl, puts it, “Acceleration of lead time is obvious when you delegate something, but quality matters too.” That balance between automation and accuracy has become the new benchmark for trust.

That’s why the most advanced teams are using GenAI to enhance reality, not invent it. At Wolt, food photos aren’t generated from scratch.

“Stock images are dangerous. Customers receive something that doesn’t look like the picture, and that breaks trust.”

–Jeff Strauss, Head of Imaging at Photoroom (Ex Director of Imaging Operations, Wolt)

Instead, Wolt uses AI for QA and enhancement, cleaning up thousands of merchant-supplied images while maintaining realism. Their team also deploys reverse image search to spot potential copyright issues before they damage credibility.

The same risk applies beyond food. In a high-liability vertical like Turo’s car-sharing marketplace, one false AI signal, such as glare mistaken for damage, can erode confidence for both hosts and renters.

And in luxury resale, Vestiaire Collective has learned that accuracy isn’t optional; it’s existential.

“The more precise you need the result, the more cautious you need to be, especially when you’re dealing with two physical objects, like a human body and a garment. It’s punishing to be wrong.”

–Stacia Carr, Chief Technology and Product Officer at Vestiaire Collective

Vestiaire now uses AI to augment rather than replace human authentication. Historical data helps flag potential counterfeits, while human experts make the final call. This human-in-the-loop model balances speed, precision, and credibility — the holy trinity of trust in AI marketplaces.

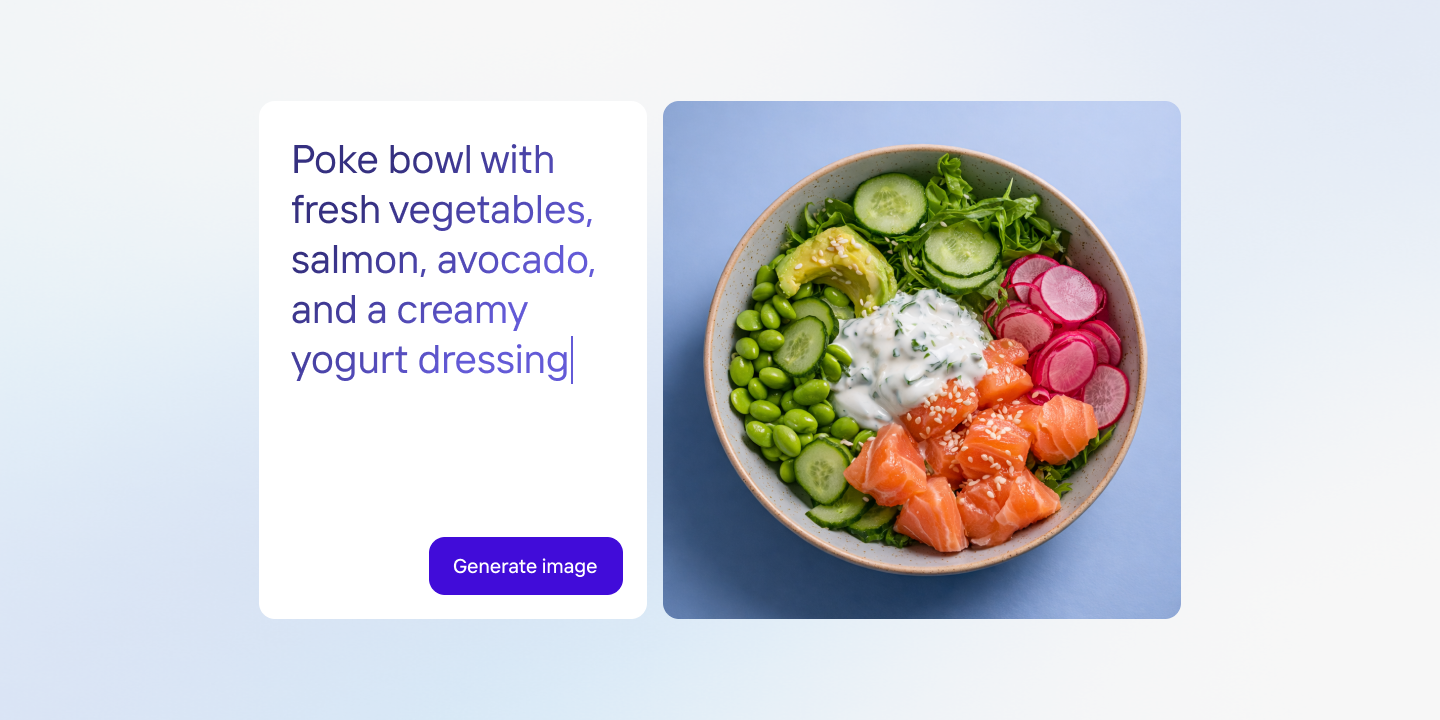

4. AI-assisted seller onboarding is solving the cold start problem

“AI can help marketplaces start even better than before by reducing the cold start problem,” says Camila Bustamante, Investor at FJ Labs. “You can now automate listings and boost demand through improved discovery and personalization, revealing customer intent faster.”

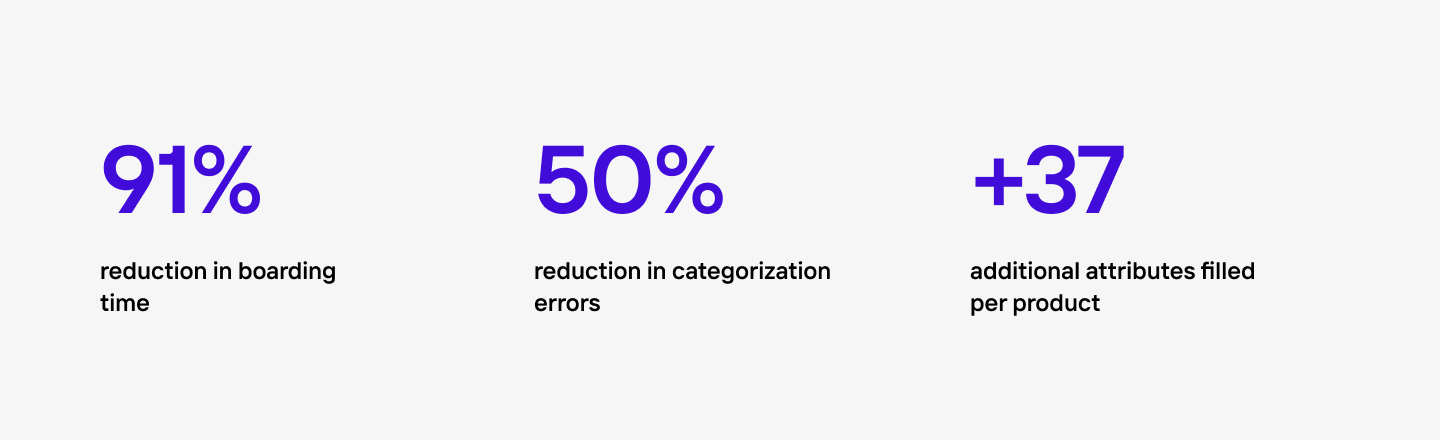

This is already happening at scale. Mirakl, the global leader in platform business innovation, reports that its AI-native Catalog Transformer has helped marketplace customers cut onboarding time by 91%, reduce categorization errors by around 50%, and fill 37 additional attributes per product.

The AI is able to manage everything in just five seconds per SKU, and that is massive.”

–Anne-Claire Baschet Chief Data & AI Officer - Agentic Commerce at Mirakl

By generating complete listings in seconds and accelerating discovery, GenAI is collapsing time-to-list and time-to-liquidity in marketplaces. “Both sellers and buyers will gravitate to platforms where there is liquidity”, says Olivia Moore, Partner at a16z. “And liquidity will come from having the best user experience. If you don’t use AI, you lose that advantage.”

Marketplaces now rely on GenAI in the following ways to remove friction across seller onboarding:

Generate or enhance photos

Extract attributes from PDFs and images

Write titles and descriptions

Suggest categories and pricing

Translate listings into multiple languages

“There’s net new supply that wouldn’t have existed before just because the snap-a-photo, create-a-listing flow is so much easier and more intuitive.”

–Olivia Moore, AI Partner at Andreessen Horowitz (a16z)

Mercari shows how this compounds when automation extends end to end. Its AI-powered description generation tool now helps create hundreds of listings per minute, with adoption growing rapidly among sellers. “If you think about the whole seller experience, we’re looking at any step that users take that can be enhanced and made super fast,” says Nick Pittoni, Product Lead at Mercari. This speed boost is also psychological: when sellers can go from idea to live listing in seconds, their confidence to list more items rises dramatically.

For marketplace operators, the signal is clear: track time-to-first-listing and time-to-first-transaction as north stars. Use GenAI not just to assist sellers, but to remove friction entirely. The marketplaces pulling ahead are those that let sellers go from zero to live in minutes, without ever touching a manual step.

5. AI enables and accelerates cross-border growth

For global marketplaces, GenAI is unlocking the next growth frontier: cross-border liquidity. What used to take months of manual translation, catalog mapping, and verification can now happen almost instantly.

Vestiaire Collective provides one of the clearest examples. By switching to LLM-based translations for listing content, the marketplace improved 7-day sell-through by around 4% in early tests, a meaningful lift at their scale.

"The LLM-based translations actually beat our copywriters.”

–Stacia Carr, Chief Technology and Product Officer at Vestiaire Collective

In some categories, the AI outperformed human copywriters entirely, prompting the team at Vestiaire Collective to rethink how messaging should vary by category and price point. That performance gain extends beyond translation; it compounds into liquidity. Faster, higher-quality translations mean listings reach new buyers faster and move more fluidly across borders.

“Listings used to be isolated by language,” says Camila Bustamante, Investor at FJ Labs. “Now launching new countries is effortless.”

FJ Labs’ portfolio shows how widespread this shift has become:

Wallapop now lists Spanish supply in Italy.

Ovoko sources auto parts in Eastern Europe and sells them to Western Europe.

CarOnSale now handles 30% of transactions cross-border, enabled by improved translation, risk modeling, and logistics coordination.

Across every example, the pattern is clear: GenAI is turning localization from a cost center into a growth driver. It enables marketplaces to translate listings across languages and taxonomies, and to standardize attributes to better map supply to demand across markets. It also strengthens verification and fraud detection for multi-country transactions.

6. AI is unlocking hidden capacity in marketplace teams

While talk of AI replacing jobs dominates headlines, both the data and our interviews point in the opposite direction. McKinsey finds that nearly 50% of companies expect no change in workforce size from AI adoption, and OpenAI reports that 75% of workers say AI improves their speed or quality, saving heavy users more than 10 hours per week.

At Wolt and Rappi, automating image QA editing didn’t lead to cuts. Instead, teams now have more time to contact merchants with incomplete or poor content, improve menu completeness, and work on higher-value projects, such as building seller relationships and improving data quality.

On the operations side, Vestiaire Collective uses tools like Dust to expand analytics and engineering output without adding headcount, redirecting a 125-person product and tech org toward higher-impact initiatives like AI-powered listing flows and authentication systems.

GenAI’s biggest impact at Turo is internal productivity. “Around 90–95% of our data and engineering team uses AI coding tools like Cursor or Claude,” says Thibaut Joncquez, Senior Director of Data Science at Turo. These tools have become embedded in their workflow, accelerating experimentation and feature delivery across teams.

7. Structured data is the bridge between AI ambition and real-world mess

“AI can’t control the real world,” says Thibaut from Turo. “And the real world is messy.” Every marketplace leader we spoke with agreed: the most complex problems aren’t AI-model problems; they’re physical-world problems.

At Turo, fully automating damage detection runs up against the limits of photography in uncontrolled environments. Hosts take photos in garages, under harsh sun, or with glare from dashboards and windows, causing reflections to look like scratches, and shadows to look like dents. AI can analyze what it’s given, but it can’t control how a photo is taken.

Rappi faces the same issue with menu extraction. PDF scans break the moment images are blurry or formatting is inconsistent. Every small variation compounds errors downstream.

At Vestiaire Collective, even reading a size tag can go wrong; a French 38 is not the same as an Italian 38. “AI can match what’s written on a label to listing fields,” says Stacia Carr. “But if the underlying standards are inconsistent, the results will be too.” The same caution applies to augmented product previews or AI-generated model imagery: they can engage users, but when they misrepresent the product, they damage trust.

“We look for marketplaces that behave like products, not just networks. In the AI era, intelligence needs to be in the loop from day one, not bolted on later.”

–Laura McGinnis, Principal at Balderton Capital

This is the new frontier: data integrity as a competitive advantage. When catalogs, attributes, and taxonomies are consistent, AI can enrich them with higher-quality photos, more accurate translations, and better discovery signals, creating a compounding loop:

First, structure the supply, including attributes, categories, and standardized formats

Next, enrich with higher-quality inputs (photos, translations, richer descriptions, and authentication signals)

Then distribute through ranking, semantic search, and personalization

Learn by observing and feeding performance indicators like conversion and engagement data back into step one

“Data and distribution may become the new moats,” says Laura McGinnis, Principal at Balderton Capital, a multistage venture firm. “Anyone can generate content, but few can generate context.”

Winning marketplaces won’t just have better AI, they’ll have tighter feedback loops, richer context, and proprietary behavioral data that make their agents smarter over time. “AI levels the tools, not the outcomes,” adds Laura. Incumbents have a head start, but new entrants can still win by owning context.

8. Agentic AI marks the new evolution of marketplaces

Agentic AI is already driving billions in online sales, and it’s coming for marketplaces next. According to Salesforce, AI agents generated $14.2 billion in global sales during Black Friday 2025, including $3 billion in the U.S. alone. Adobe data shows AI-driven retail traffic jumped 805% year over year. And McKinsey projects that by 2030, agentic commerce could power $1 trillion in U.S. transactions and as much as $5 trillion globally.

This marks a new phase in marketplace evolution, from assistance to delegation and autonomy. An agentic marketplace is one where autonomous AI systems don’t just assist users, but take action: creating listings, optimizing pricing, matching supply to intent, and completing transactions with minimal human input. “We’re moving from marketplaces that just show you options to marketplaces that get things done,” says Laura McGinnis from Balderton Capital.

For platform enablers like Mirakl, which powers hundreds of global marketplaces, this shift is already operational.

“We changed our approach and by delegating catalog tasks to AI and then reviewing it, we completed a two-week process in under 24 hours.”

–Anne-Claire Baschet, Chief Data & AI Officer – Agentic Commerce at Mirakl

Before automation, transforming or onboarding product catalogs could take close to two weeks of manual review. Even with partial AI assistance, the process averaged around 11 days. Once Mirakl adopted a delegate-then-review model, letting AI handle categorization, attribute completion, and enrichment before human validation, the same work now happens in under 24 hours, with the AI completing each SKU in roughly five seconds.

Nearly 60% of shoppers already use AI during at least one step of their journey, and one in four Americans say ChatGPT now beats Google for product research. “Users are not looking for a product,” says Anne-Claire. “They’re looking for something that solves their problem.”

This shift in intent is transforming commerce dynamics. As analyst Ben Thompson notes, GenAI is reshaping the “long tail” of commerce, surfacing niche or under-the-radar products that perfectly fit unique needs, rather than just amplifying bestsellers. Platforms like Etsy and Shopify stand to benefit most, as AI connects intent with supply that traditional search would never have surfaced.

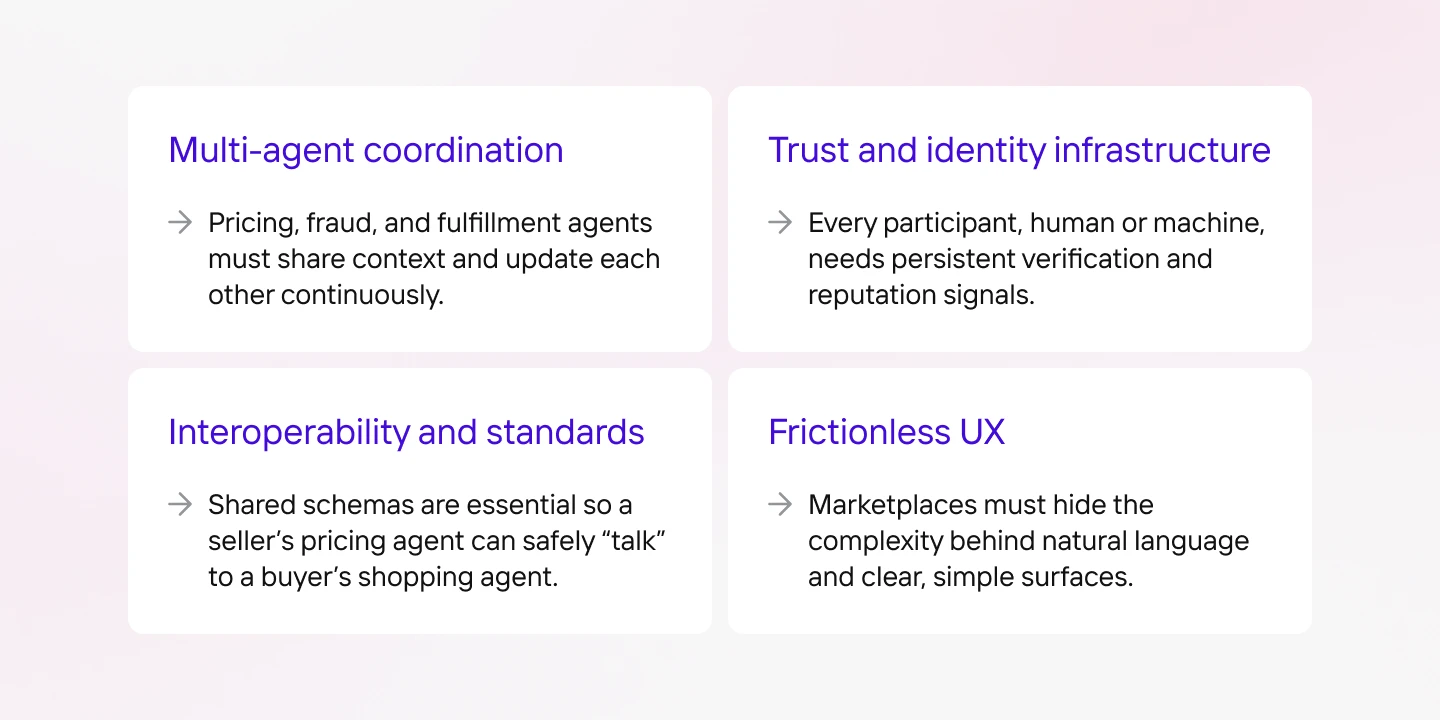

Marketplaces are evolving from intermediaries into agentic commerce systems with specialized agents managing pricing, fraud, discovery, and customer intent in real time. Everyone in the commerce ecosystem will need to adapt, from brands and marketplaces to logistics and payments, as new expectations around trust, risk, and innovation take shape. But most operators aren’t ready. Across interviews, four structural weaknesses appeared repeatedly:

Fragmented and inconsistent catalog data

Legacy systems that collapse under new AI workloads

Weak feedback loops between buyers and sellers

Underdeveloped trust and identity infrastructure

“Agents and infrastructure will only work if identity, reputation, and data lineage are baked in.”

–Laura McGinnis, Principal at Balderton Capital

What an agentic marketplace needs to work

According to Balderton, four foundations must be in place before agentic marketplaces can operate safely and effectively:

This human-centered design principle will matter even more as marketplaces evolve toward closed-loop agentic systems, where feedback between users, merchants, and AI happens automatically. Nicolas Morales of Rappi, describes their vision: “Users say, “You’re missing this dish.” → Rappi alerts merchants → Rappi auto-creates listings and images.” That’s agentic commerce in motion; intent captured, supply generated, and fulfillment triggered in one continuous loop.

“We’re at the beginning of this,” says McGinnis. “It unlocks an entirely new layer of efficiency and personalization.” It’s no longer just about liquidity, AI helps marketplaces do more with what they already have.

9. LLMs are becoming the new interface for product discovery

Large Language Models are reshaping how people find products, and increasingly, where they buy them. “LLMs will not replace marketplaces,” says Camila Bustamante, Investor at FJ Labs. “Marketplaces will continue to lead because they own three things that LLMs cannot generate on their own: liquidity, vertical expertise, and historical transaction data.”

That balance is evolving fast. Our research shows that one in four shoppers already use AI tools to compare or decide what to buy, a habit concentrated among younger consumers. And Google’s new Universal Checkout Protocol (UCP) now allows shoppers to check out directly from retailers while browsing in AI Mode or AI Overviews, collapsing the gap between discovery and purchase.

Still, most buying journeys depend on marketplaces’ structured catalogs, verified listings, and fulfillment infrastructure to make transactions work reliably at scale.

Camila breaks online shopping behavior into three modes:

Browsing for entertainment. Marketplaces already win here; scrolling real supply is a product in itself.

Searching for something specific. Entrenched players like Amazon, eBay, and category leaders dominate because they own the inventory and behavioral data.

“I don’t know what I need yet.” This is where LLMs step in, translating vague intent into potential options. But they still depend on marketplaces to complete the loop with verified listings, real-time prices, and fulfillment.

“We still have depth of understanding of the assortment, the authentication, and everything around the legitimacy of the product,” says Stacia Carr, Chief Technology and Product Officer at Vestiaire Collective. “I don’t see that going away; it’s a matter of how we join forces with LLMs and leverage what each other does best.”

Vestiaire Collective is already exploring LLM-based commerce integrations, but Stacia warns of risks. For rare items or fast-changing inventories, AI summaries can easily misrepresent stock or pricing. “The question is, how do we get there without ‘gaming the system’ in a way that’s misleading to customers?” says Stacia. “At the end of the day, it's advertising really, and we see LLMs as another partner.”

10. AI-native marketplaces are emerging as new competitors

For years, many marketplace ideas failed not because demand didn’t exist, but because the math didn't work. High CAC, low LTV, and operational overhead made once-promising models unsustainable. But now, “You don’t need 50 operations people to launch a marketplace anymore,” says Laura McGinnis, Principal at Balderton Capital.

Just as mobile unlocked entirely new marketplace categories, from Uber to DoorDash, by making information richer through GPS and real-time connectivity, GenAI is now doing the same for operations, creativity, and scale. It’s the next major platform shift after the internet and mobile, removing structural costs and expanding what kinds of marketplaces can exist.

“AI is making ‘white whale’ categories like home services, cars, and high-skill talent viable by changing unit economics and scalability,” explains Olivia Moore, AI Partner at Andreessen Horowitz (a16z).

“Marketplaces that never could have existed, because they didn’t work from an LTV to CAC standpoint before AI, can now succeed.”

–Olivia Moore, AI Partner at Andreessen Horowitz (a16z)

The new generation of AI-native marketplaces won’t look radically different to users, but they’ll operate on entirely different foundations. AI will handle catalog creation, onboarding, fraud checks, pricing, and even personalized discovery, reducing operational load by an order of magnitude. “AI-native marketplaces will emerge as new competitors,” says Nick Pittoni, Product Lead at Mercari. “AI will make selling effortless, near-instant, and accessible to users who currently find marketplaces too much work.”

“Our leadership went from ‘Back to Startup’ to ‘AI Native’. That’s our mantra now.”

–Nick Pittoni, Product Lead at Mercari

What marketplace operators need to do now

AI is no longer a tool for marketplaces, it’s becoming the connective tissue that powers how they operate, scale, and grow.

“If marketplaces don’t embrace AI, they risk losing sellers, losing buyers, and becoming invisible behind AI agents. Liquidity will come from having the best user experience.”

–Olivia Moore, AI Partner at Andreessen Horowitz (a16z)

Yet even as adoption accelerates, trust and data quality remain the biggest barriers to scaling autonomous systems. In our consumer survey, one in three shoppers said they’re comfortable with AI-enhanced product images if clearly labeled, but 41% remain uneasy. Transparency alone isn’t enough.

For marketplaces to lead in the AI era, they must build the infrastructure of trust first; accurate data, clear labeling, and human oversight, before layering in more advanced automation.

Across all our interviews, commissioned surveys, and external data, four imperatives stand out for marketplace operators:

Start with the foundation

Invest in catalog structuring, attribute extraction, and image QA. Standardize schemas, clean pipelines, and centralize feedback loops. Without this groundwork, agents, assistants, and AI-driven features will underperform.

Use AI to scale capacity, not cut it

Expect to restructure teams, not replace people. Measure time saved and backlog cleared, then redirect that capacity toward growth; onboarding more sellers, expanding cross-border, and accelerating product innovation. Treat AI as a multiplier for ambition, not a substitute for headcount.

Design for trust and real-world messiness

Use AI to enhance reality, not fabricate it, especially in food, fashion, and other high-stakes categories. Build guardrails around tasks where precision defines credibility: fit, feel, authentication, and damage detection. Improve input quality through seller guidance, improved UX, and incentives, just as aggressively as you improve AI models.

Build toward an agentic, AI-native future

Start small: pricing helpers, listing co-pilots, and fraud triage, all anchored in clean data and clear rules. Normalize attributes, translations, and compliance for cross-border readiness. Assume that future AI front ends (like LLM assistants and conversational commerce tools) will route into the best-structured marketplaces. Make sure that’s you.

“The future I’m most excited about is one where marketplaces feel frictionless. AI will quietly embed in every layer, making things simpler for everyone involved.”

–Olivia Moore, AI Partner at Andreessen Horowitz (a16z)

In the decade ahead, the marketplaces that win won’t just use AI, they’ll weave it through every layer of their operations. They’ll bake intelligence into seller and buyer workflows, automate the messy middle of catalog and content operations, and turn trust itself into a competitive advantage.

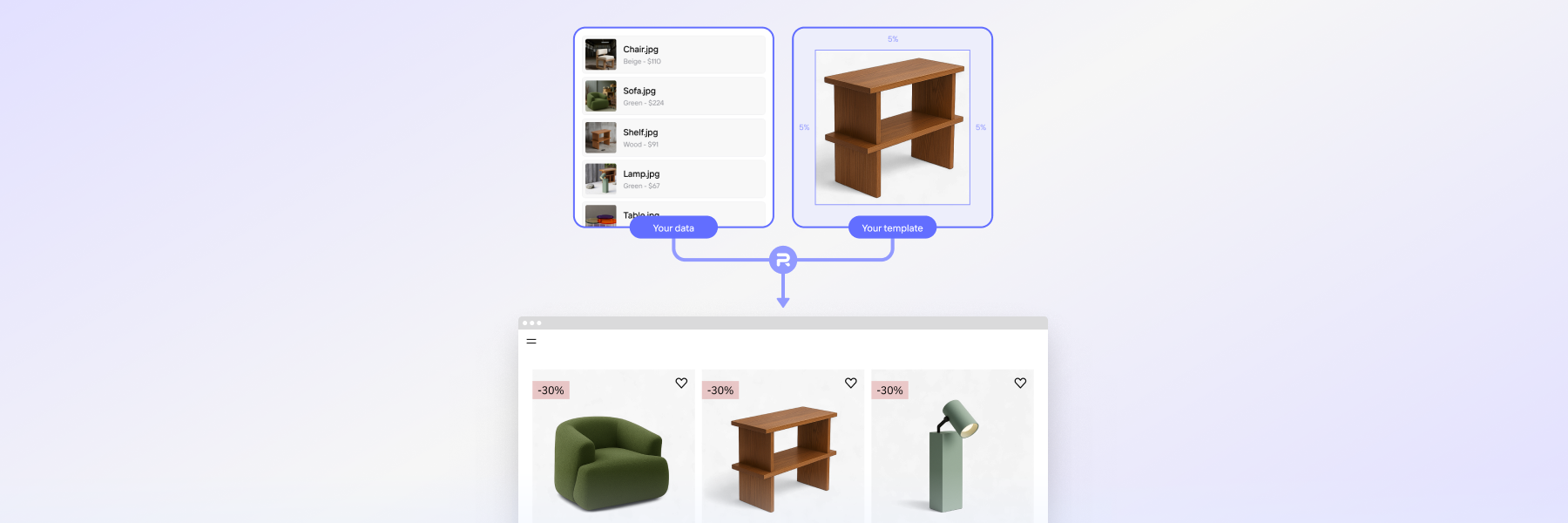

Process millions of product images in seconds

Trusted by leading marketplaces like Mercari, Rappi, DoorDash, and Poshmark to create consistent, professional visuals at scale.

About Photoroom

Founded in 2019, Photoroom has quickly become the world’s most popular AI-powered photo editing and design platform, carving out a niche in e-commerce photography. With over 300 million downloads across 180+ countries, Photoroom ranks among the top six most-used generative AI products globally.

Photoroom supports SMBs, enterprise teams and prosumers by enabling fast, accurate and consistent visual production across mobile, web and API. Known for its best-in-class background removal, the platform now includes batch editing and generative AI tools such as AI Backgrounds, AI Shadows, Virtual Model, Product Staging, and more.

Processing over 7 billion images per year, Photoroom offers a complete solution for creating product images at scale, empowering businesses to launch faster, sell more, and cut photography costs without compromising quality.

Methodology

Photoroom’s State of GenAI in Marketplaces 2026 report is based on qualitative research conducted through in-depth interviews with leading marketplace operators and investors across the United States, Europe, Asia, and Latin America.

We combined this data with a commissioned UK consumer survey of 2,000 people and external data to uncover common themes in GenAI adoption, key challenges, and emerging opportunities for marketplace innovation.

Photoroom’s content team spoke with ten marketplace experts from the following organizations:

Anne-Claire Baschet, Chief Data & AI Officer at Agentic Commerce at Mirakl, the global leader in platform business innovation.

Camila Bustamante, Investor at FJ Labs, a stage-agnostic venture fund focused on marketplaces and network-effect businesses.

Jeff Strauss, Head of Imaging at Photoroom and former Director of Imaging Operations at Wolt, a Helsinki-based marketplace connecting customers with local merchants for food, grocery, and retail delivery.

Laura McGinnis, Principal at Balderton Capital, a multistage venture firm with over two decades of experience supporting Europe’s top founders from Seed to IPO.

Matt Rouif, CEO at Photoroom, the leading AI-powered photo editor and listing studio for product photography and e-commerce visuals.

Nick Pittoni, Product Lead at Mercari, a Tokyo-based C2C marketplace app enabling anyone to easily sell and buy items via smartphone.

Nicolas Morales, Product Director at Rappi, a Latin-American marketplace and first SuperApp in the region, helping SMEs grow their businesses.

Olivia Moore, AI Partner at Andreessen Horowitz (a16z), a venture capital firm backing bold entrepreneurs building the future through technology.

Stacia Carr, Chief Technology and Product Officer at Vestiaire Collective, the leading global marketplace for pre-loved luxury fashion.

Thibaut Joncquez, Senior Director of Data Science at Turo, the world’s largest car-sharing marketplace operating in the U.S., U.K., Canada, Australia, and France.